All Categories

Featured

Table of Contents

That usually makes them an extra affordable alternative for life insurance protection. Lots of people obtain life insurance coverage to aid monetarily shield their loved ones in case of their unforeseen fatality.

Or you might have the choice to convert your existing term coverage into an irreversible plan that lasts the remainder of your life. Different life insurance policy policies have possible advantages and drawbacks, so it's essential to recognize each prior to you determine to purchase a policy.

As long as you pay the costs, your beneficiaries will certainly get the fatality benefit if you pass away while covered. That said, it is essential to note that a lot of policies are contestable for 2 years which implies coverage could be retracted on death, must a misstatement be found in the application. Plans that are not contestable commonly have a rated survivor benefit.

What is What Is Direct Term Life Insurance? Your Guide to the Basics?

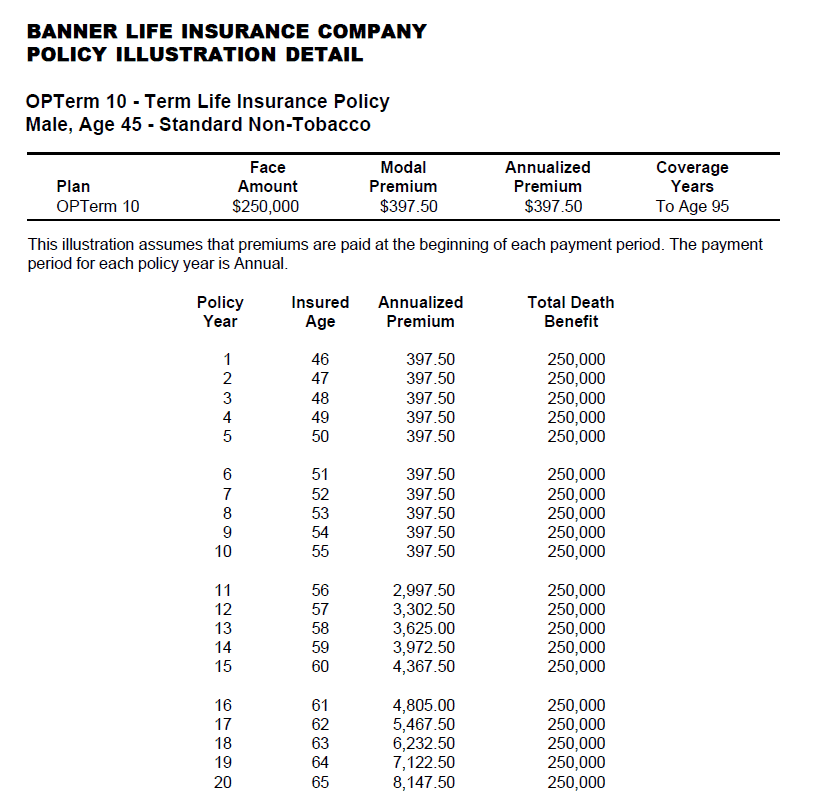

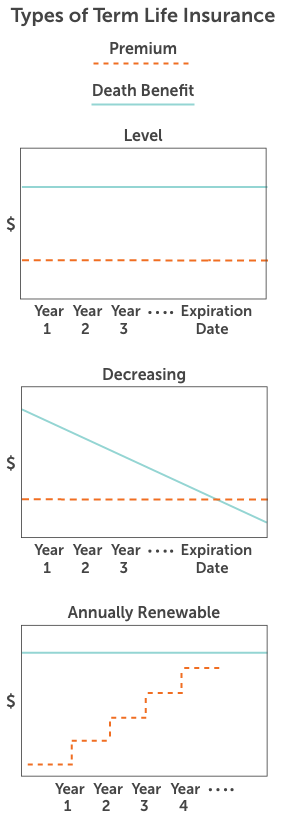

Costs are usually less than entire life plans. With a level term plan, you can pick your insurance coverage amount and the policy size. You're not locked right into a contract for the rest of your life. Throughout your policy, you never ever need to stress regarding the premium or survivor benefit quantities changing.

And you can not cash out your plan throughout its term, so you won't obtain any economic take advantage of your past protection. As with various other kinds of life insurance coverage, the expense of a level term policy relies on your age, insurance coverage requirements, work, way of life and health and wellness. Typically, you'll discover more affordable protection if you're younger, healthier and much less dangerous to insure.

Given that level term premiums stay the same for the duration of coverage, you'll know exactly just how much you'll pay each time. That can be a large assistance when budgeting your expenses. Degree term coverage also has some flexibility, allowing you to tailor your policy with additional attributes. These frequently been available in the kind of riders.

Understanding the Benefits of Term Life Insurance

You might need to satisfy certain problems and certifications for your insurance firm to pass this motorcyclist. Additionally, there might be a waiting period of approximately 6 months before working. There also might be an age or time restriction on the coverage. You can include a kid cyclist to your life insurance policy plan so it also covers your youngsters.

The fatality advantage is normally smaller sized, and insurance coverage normally lasts until your child transforms 18 or 25. This rider may be a more cost-efficient means to aid guarantee your kids are covered as riders can typically cover multiple dependents simultaneously. When your kid ages out of this insurance coverage, it might be feasible to convert the cyclist into a brand-new plan.

When contrasting term versus long-term life insurance policy, it's vital to keep in mind there are a few various types. The most common kind of irreversible life insurance policy is entire life insurance policy, however it has some vital differences contrasted to degree term protection. 20-year level term life insurance. Below's a standard summary of what to consider when comparing term vs.

Entire life insurance coverage lasts for life, while term protection lasts for a certain period. The costs for term life insurance coverage are typically less than whole life coverage. However, with both, the costs stay the exact same for the duration of the plan. Entire life insurance has a cash money value part, where a section of the premium may expand tax-deferred for future requirements.

Among the highlights of degree term coverage is that your premiums and your fatality advantage do not alter. With lowering term life insurance policy, your premiums remain the same; nonetheless, the survivor benefit quantity obtains smaller with time. For instance, you may have protection that begins with a survivor benefit of $10,000, which can cover a home loan, and then annually, the survivor benefit will decrease by a collection quantity or percentage.

Due to this, it's commonly a more inexpensive type of degree term coverage., yet it may not be sufficient life insurance policy for your demands.

What is Level Benefit Term Life Insurance? How It Works and Why It Matters?

After deciding on a policy, finish the application. If you're approved, sign the paperwork and pay your initial premium.

Ultimately, take into consideration scheduling time every year to examine your policy. You may wish to upgrade your recipient info if you have actually had any significant life adjustments, such as a marital relationship, birth or separation. Life insurance policy can occasionally really feel challenging. However you don't have to go it alone. As you explore your options, take into consideration discussing your needs, desires and concerns with a monetary expert.

No, degree term life insurance policy does not have money value. Some life insurance policy policies have a financial investment attribute that allows you to develop money value gradually. A part of your premium settlements is reserved and can make passion in time, which grows tax-deferred throughout the life of your coverage.

However, these policies are typically substantially extra costly than term protection. If you get to the end of your plan and are still to life, the coverage finishes. Nonetheless, you have some options if you still desire some life insurance policy protection. You can: If you're 65 and your protection has actually run out, for instance, you might wish to purchase a new 10-year degree term life insurance policy.

What is Decreasing Term Life Insurance? How It Works and Why It Matters?

You may have the ability to transform your term coverage right into a whole life plan that will last for the remainder of your life. Many kinds of level term plans are exchangeable. That means, at the end of your insurance coverage, you can convert some or all of your plan to whole life coverage.

A level costs term life insurance policy plan lets you stick to your budget plan while you assist safeguard your family members. Unlike some tipped price strategies that enhances yearly with your age, this kind of term plan uses prices that stay the very same through you select, even as you grow older or your health modifications.

Find out more concerning the Life insurance policy alternatives available to you as an AICPA member (Term life insurance level term). ___ Aon Insurance Policy Solutions is the brand name for the broker agent and program management operations of Fondness Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Firm, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Solutions, Inc .

Latest Posts

New Funeral Expense Benefit

Funeral Expenses Plan

Best Burial