All Categories

Featured

Table of Contents

- – Who has the best customer service for Level Te...

- – Why is Level Death Benefit Term Life Insurance...

- – How do I compare Level Death Benefit Term Lif...

- – How long does Guaranteed Level Term Life Insu...

- – Who are the cheapest No Medical Exam Level T...

- – Why should I have Level Term Life Insurance ...

Degree term life insurance policy is one of the least expensive insurance coverage alternatives on the marketplace due to the fact that it supplies basic protection in the kind of fatality advantage and just lasts for a collection period of time. At the end of the term, it ends. Entire life insurance policy, on the other hand, is significantly extra expensive than degree term life due to the fact that it does not end and includes a money value function.

Prices may vary by insurance firm, term, insurance coverage amount, wellness class, and state. Degree term is a great life insurance policy choice for a lot of individuals, yet depending on your coverage demands and individual scenario, it may not be the finest fit for you.

Who has the best customer service for Level Term Life Insurance For Families?

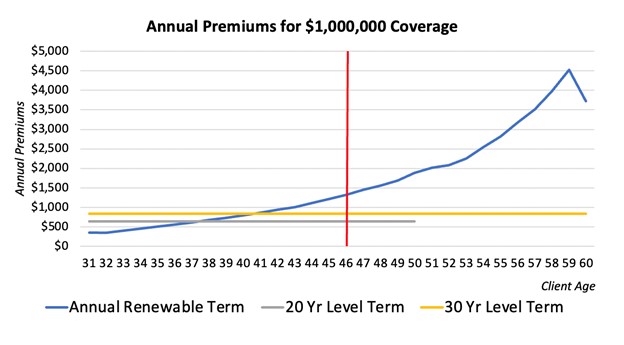

Yearly sustainable term life insurance policy has a regard to only one year and can be renewed yearly. Yearly sustainable term life costs are at first lower than level term life costs, but costs rise each time you renew. This can be a great alternative if you, for instance, have just quit cigarette smoking and need to wait 2 or three years to look for a degree term policy and be eligible for a lower price.

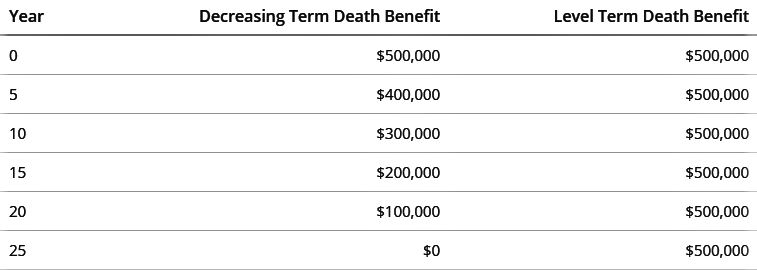

, your death benefit payment will certainly reduce over time, however your settlements will certainly stay the same. On the other hand, you'll pay even more upfront for much less insurance coverage with an enhancing term life policy than with a degree term life plan. If you're not sure which kind of policy is best for you, functioning with an independent broker can assist.

Why is Level Death Benefit Term Life Insurance important?

Once you've made a decision that level term is best for you, the next step is to acquire your plan. Below's exactly how to do it. Calculate just how much life insurance you need Your coverage quantity must offer your family's long-lasting monetary needs, including the loss of your income in case of your death, along with financial obligations and day-to-day expenses.

As you try to find methods to safeguard your monetary future, you've likely stumbled upon a variety of life insurance policy choices. Choosing the best coverage is a large decision. You wish to discover something that will assist support your enjoyed ones or the reasons vital to you if something takes place to you.

Numerous people lean toward term life insurance coverage for its simplicity and cost-effectiveness. Level term insurance, nevertheless, is a type of term life insurance coverage that has consistent payments and an unchanging.

How do I compare Level Death Benefit Term Life Insurance plans?

Degree term life insurance policy is a subset of It's called "level" since your premiums and the advantage to be paid to your enjoyed ones stay the same throughout the contract. You will not see any type of adjustments in expense or be left questioning regarding its worth. Some agreements, such as yearly eco-friendly term, may be structured with costs that boost gradually as the insured ages.

They're identified at the beginning and continue to be the same. Having regular repayments can help you much better strategy and spending plan due to the fact that they'll never transform. Compare level term life insurance. Taken care of survivor benefit. This is likewise evaluated the start, so you can recognize specifically what fatality advantage amount your can anticipate when you pass away, as long as you're covered and up-to-date on costs.

How long does Guaranteed Level Term Life Insurance coverage last?

You concur to a fixed premium and death advantage for the period of the term. If you pass away while covered, your fatality advantage will certainly be paid out to loved ones (as long as your costs are up to day).

You might have the choice to for an additional term or, a lot more likely, renew it year to year. If your agreement has a guaranteed renewability stipulation, you might not require to have a new clinical examination to maintain your protection going. However, your costs are likely to raise due to the fact that they'll be based upon your age at revival time. Level premium term life insurance.

With this choice, you can that will certainly last the rest of your life. In this situation, once again, you may not require to have any type of new medical examinations, but premiums likely will increase due to your age and new protection. Different companies offer various choices for conversion, make certain to recognize your selections before taking this action.

A lot of term life insurance is level term for the period of the contract period, but not all. With lowering term life insurance policy, your death advantage goes down over time (this kind is usually taken out to particularly cover a long-lasting debt you're paying off).

Who are the cheapest No Medical Exam Level Term Life Insurance providers?

And if you're established for renewable term life, then your premium likely will increase annually. If you're exploring term life insurance policy and wish to ensure uncomplicated and foreseeable economic protection for your household, level term might be something to consider. As with any type of coverage, it may have some constraints that do not meet your demands.

Generally, term life insurance coverage is more budget-friendly than long-term insurance coverage, so it's a cost-efficient method to safeguard monetary security. At the end of your agreement's term, you have multiple alternatives to proceed or relocate on from coverage, usually without needing a clinical examination (Level term life insurance companies).

Why should I have Level Term Life Insurance Premiums?

Similar to other sort of term life insurance policy, once the agreement finishes, you'll likely pay greater costs for insurance coverage due to the fact that it will recalculate at your current age and wellness. Dealt with protection. Degree term provides predictability. However, if your monetary situation changes, you might not have the essential insurance coverage and may need to acquire extra insurance.

Yet that doesn't suggest it's a suitable for everyone. As you're going shopping for life insurance, below are a couple of vital factors to consider: Budget plan. One of the benefits of degree term insurance coverage is you understand the price and the death benefit upfront, making it less complicated to without fretting about increases gradually.

Generally, with life insurance coverage, the healthier and more youthful you are, the extra inexpensive the coverage. Your dependents and financial obligation play a function in determining your coverage. If you have a young family, for circumstances, level term can help provide financial support throughout crucial years without paying for protection longer than needed.

Table of Contents

- – Who has the best customer service for Level Te...

- – Why is Level Death Benefit Term Life Insurance...

- – How do I compare Level Death Benefit Term Lif...

- – How long does Guaranteed Level Term Life Insu...

- – Who are the cheapest No Medical Exam Level T...

- – Why should I have Level Term Life Insurance ...

Latest Posts

New Funeral Expense Benefit

Funeral Expenses Plan

Best Burial

More

Latest Posts

New Funeral Expense Benefit

Funeral Expenses Plan

Best Burial